There's a competitive intelligence system hiding in plain sight that most businesses never exploit. While companies invest tens of thousands in market research, competitive analysis, and positioning consultants, their waitlists are quietly accumulating strategic intelligence about competitor weaknesses, untapped market segments, and positioning opportunities that would cost millions to discover through traditional research—yet most businesses never analyze this data beyond basic signup counts.

The competitive intelligence value emerges from a fundamental insight: who joins your waitlist, when they join, why they join, and what they're switching from reveals your competitive advantages and market positioning opportunities with precision that surveys and focus groups can't replicate. This behavioral data eliminates the response bias and hypothetical thinking that undermines traditional competitive research.

Understanding how to mine waitlist data for competitive intelligence transforms waitlists from marketing tools into strategic assets that inform product development, positioning strategy, and competitive responses with empirical precision rather than educated guesses.

The Competitive Switching Pattern Analysis

The most valuable competitive intelligence often comes from understanding which competitors your waitlist members are currently using or evaluating. This switching pattern reveals competitor vulnerabilities, feature gaps, and positioning weaknesses that create market entry opportunities.

Switching analysis examines several key dimensions: which competitors' customers join your waitlist most frequently, what specific pain points drive switching consideration, which competitor features fail to satisfy needs, and which use cases competitors serve inadequately. These insights identify exactly where competitors are vulnerable to competitive displacement.

The switching data becomes particularly valuable when correlated with customer success outcomes. Switchers from specific competitors often show distinct retention patterns, expansion behaviors, and satisfaction levels. Understanding these patterns enables targeting competitors whose customers are most likely to succeed with your product—maximizing marketing efficiency while building competitive advantages in specific competitive matchups.

Figma discovered powerful competitive intelligence through analyzing which design tools their waitlist members were currently using. They found that Sketch users joined their waitlist at 5.7x higher rates than Adobe Creative Suite users, despite Adobe having larger market share. This disparity revealed that Sketch had created demand for collaborative design tools but hadn't fully satisfied that demand—creating a perfect market entry opportunity. Figma focused their positioning and feature development on addressing Sketch limitations specifically, enabling them to capture market share from their most vulnerable competitor rather than attacking Adobe's entrenched position directly.

The Geographic Competitor Weakness Mapping

Waitlist geographic patterns reveal where competitors have weak market presence or poor brand penetration. High waitlist signup rates from specific cities or regions indicate markets where customers are actively seeking alternatives to incumbents—signaling competitive vulnerability that can be exploited through focused market entry.

Geographic intelligence is particularly valuable because it enables concentrating competitive attacks on vulnerable markets rather than fighting entrenched competitors everywhere simultaneously. Markets showing high organic interest despite minimal marketing investment signal fundamental competitor weaknesses that make market penetration efficient.

The geographic data also reveals expansion sequencing opportunities. Markets where competitors are weak provide easier entry points that build revenue and momentum for subsequent attacks on competitors' strongholds. This strategic geographic sequencing transforms competitive dynamics from symmetric warfare across all markets into asymmetric advantages through selective market targeting.

Zoom identified critical geographic intelligence when they noticed unexpectedly high waitlist signups from specific European cities where WebEx and Skype had strong market presence. Investigation revealed that these markets were frustrated with incumbent solutions but lacked awareness of alternatives. Zoom concentrated their European expansion resources on these vulnerable markets first, achieving strong positions before competitors recognized the threat. The concentrated geographic strategy enabled faster European market penetration than broad simultaneous expansion would have achieved.

The Firmographic Segmentation Insight

Company size, industry, and role patterns in waitlist signups reveal which customer segments find competitor solutions inadequate. These firmographic patterns identify underserved market segments where competitors have focused on large enterprises while neglecting SMBs, or vice versa—creating whitespace opportunities for differentiated positioning.

Firmographic analysis examines whether waitlist members come primarily from startups, mid-market companies, or enterprises—revealing which segments face unmet needs. Industry concentration patterns show which verticals feel poorly served by horizontal competitor solutions. Role and department concentrations indicate whether competitors satisfy technical users while neglecting business users, or satisfy individual contributors while failing team managers.

The segmentation intelligence enables precise positioning that targets competitor weaknesses. Instead of positioning as "better" generically, businesses can position as specifically better for the underserved segments revealed by waitlist patterns. This focused positioning resonates powerfully with target segments while avoiding direct confrontation with competitors in their strength areas.

Airtable discovered valuable firmographic intelligence when analyzing their waitlist composition. They found that marketing teams and non-technical business users joined at 4.1x higher rates than engineering teams, despite database and spreadsheet competitors focusing primarily on technical users. This pattern revealed that existing solutions failed to serve non-technical users who needed database functionality but found traditional tools too complex. Airtable focused their entire product and positioning strategy on this underserved segment, enabling them to build substantial business without directly competing with technical database incumbents for engineering teams.

The Feature Request Pattern Recognition

What waitlist members request, complain about, or prioritize reveals competitor feature gaps that create differentiation opportunities. When specific feature requests appear consistently across waitlist interactions, they signal unmet needs that competitors have failed to address—creating positioning opportunities around those unserved needs.

Feature pattern analysis goes beyond surface-level requests to understand underlying job-to-be-done gaps. Multiple feature requests often stem from single underlying problems that competitors haven't recognized or prioritized. Identifying these root problems enables building solutions that address fundamental needs rather than incremental features.

The feature intelligence also reveals which problems customers have given up trying to solve with competitors. Features that customers request excitedly rather than as improvements to existing capabilities indicate entirely new value propositions that competitors haven't attempted. These represent blue ocean positioning opportunities rather than incremental competitive advantages.

Notion identified a critical feature pattern when waitlist members consistently described wanting to "connect their notes, projects, and databases in a single workspace" despite using separate tools for each function. This pattern revealed that competitors in note-taking, project management, and database categories were all failing to provide unified solutions—forcing customers to maintain disconnected tools with integration friction. Notion built their entire product strategy around solving this unification problem that none of their category competitors had prioritized, creating a new product category rather than competing directly in established ones.

The Competitive Mention Analysis

How waitlist members describe competitors—which competitors they mention, what they say about them, what language they use—reveals positioning perceptions and competitive vulnerabilities. This unprompted commentary provides honest competitor assessments that formal research rarely captures.

Mention analysis examines several dimensions: which competitors are top-of-mind (most frequently mentioned), what emotional language customers use when discussing competitors, which competitor weaknesses customers articulate clearly, and which aspects of competitor solutions frustrate customers most. These insights reveal positioning opportunities that exploit competitor perceptions.

The mention patterns also indicate competitive set definitions from customer perspectives. Customers often compare products differently than company positioning suggests—revealing unexpected competitive relationships and positioning opportunities. Understanding true competitive sets from customer viewpoints enables more effective positioning than assuming competitive relationships based on product categories.

Slack discovered unexpected competitive intelligence through mention analysis in their early waitlist interactions. They found that customers consistently compared them to email rather than to other chat platforms like HipChat or Campfire. This revealed that customers saw email overload as their primary problem, not inadequate team chat tools. Slack adjusted their positioning to focus on "email killer" messaging rather than "better team chat" messaging, addressing the actual problem customers articulated rather than the category competition they assumed. This customer-informed positioning enabled much faster market penetration than competing directly with incumbent chat platforms would have achieved.

The Timing and Urgency Signals

When people join waitlists relative to product announcement timing, how urgently they request access, and what triggers their signup reveals market readiness and competitive dissatisfaction intensity. These timing patterns identify when markets reach tipping points where competitor switching becomes likely—enabling strategic timing of competitive attacks.

Timing analysis examines whether waitlist growth accelerates around specific events like competitor price increases, competitor incidents, or industry changes that create switching windows. These acceleration patterns reveal when customers are most receptive to competitive alternatives—enabling concentrated marketing during high-conversion windows.

Urgency signals also identify customer segments experiencing acute pain that makes them willing to switch despite switching costs. High-urgency segments convert faster and pay premium prices because their competitive dissatisfaction is severe. Identifying these segments enables prioritizing them for early access and focused customer acquisition.

The Price Sensitivity Revelation

How waitlist members discuss pricing, which pricing tiers they express interest in, and what price-related concerns they articulate reveals competitive pricing vulnerabilities. This intelligence identifies whether competitors are overpricing (creating opportunities for disruption) or underpricing (indicating willingness to pay premium prices for better solutions).

Price sensitivity patterns also reveal segment-specific pricing opportunities. Some customer segments show low price sensitivity and high feature demand, suggesting premium tier potential. Others emphasize value and affordability, suggesting opportunities for simplified products at lower price points that address competitor overserving.

The pricing intelligence enables strategic pricing that exploits competitor pricing weaknesses. If competitors have raised prices substantially, aggressive pricing can capture share. If competitors compete primarily on price, premium positioning can capture customers willing to pay more for better solutions.

The Unmet Use Case Discovery

What waitlist members want to accomplish that they can't with competitors reveals fundamental market gaps that represent new category creation opportunities rather than direct competition. These use case discoveries often represent the highest-value competitive intelligence because they identify growth opportunities beyond zero-sum market share battles.

Use case analysis examines how customers describe what they hope to accomplish, which existing tool combinations they're trying to replace, and which problems they've given up trying to solve. These descriptions reveal whether opportunities exist for consolidation, integration, or entirely new approaches to familiar problems.

Unmet use cases are particularly valuable when they appear consistently across different customer segments and industries—indicating systematic market failures that represent large addressable markets rather than niche requirements.

Calendly discovered a critical unmet use case through waitlist interactions where customers described wanting "to share my availability without endless email chains" rather than "to schedule meetings better." This subtle language distinction revealed that customers saw the problem as communication friction rather than calendar management. Competitors in scheduling software had focused on calendar features while missing the core job-to-be-done around communication efficiency. Calendly built their positioning around eliminating scheduling communication rather than adding scheduling features, addressing the actual use case customers articulated rather than competing on features with incumbent calendar tools.

The Integration and Ecosystem Insight

Which tools waitlist members currently use, which integrations they request, and how they describe their current workflows reveals ecosystem positioning opportunities. Understanding customer technology stacks identifies integration priorities that enable product adoption within existing workflows rather than requiring wholesale technology replacement.

Ecosystem intelligence also reveals which platforms create distribution opportunities. If waitlist members predominantly use specific CRMs, project management tools, or communication platforms, building deep integrations with those platforms creates growth channels and positioning advantages.

The ecosystem data can reveal platform consolidation opportunities. When customers describe using many different tools for related functions, it signals market appetite for consolidated solutions that reduce tool proliferation—creating positioning opportunities around simplification and integration.

The Competitive Timeline Intelligence

How long waitlist members have used competitor products, when they started evaluating alternatives, and what triggered their search reveals competitor lifecycle patterns and switching triggers. This timeline intelligence identifies when customers become vulnerable to switching and what events create switching consideration.

Timeline patterns show whether competitor relationships degrade over time (suggesting satisfaction decreases as usage deepens) or remain stable (suggesting switching is triggered by external events rather than gradual dissatisfaction). Understanding these patterns enables timing marketing to coincide with high-probability switching windows.

The timeline data also reveals whether markets have sudden trigger events or gradual switching patterns. Industries with contract renewal cycles create predictable switching windows. Markets with frequent regulatory or technology disruptions create event-triggered switching opportunities.

The Referral Network Intelligence

Who refers whom to your waitlist, which organizations show clustered signups, and which professional networks drive referrals reveals network effects opportunities and viral growth patterns that indicate positioning resonance within specific communities.

Referral analysis identifies which customer types have high viral coefficients and strong network effects—indicating ideal customer profiles for concentrated acquisition. These high-viral segments amplify marketing investments through organic growth that lower-viral segments don't generate.

Network patterns also reveal community and thought leader identification opportunities. Influencers whose referrals drive substantial waitlist growth become strategic partners for market penetration. Communities showing organic growth indicate positioning resonance that should be reinforced and amplified.

The Content and Messaging Response

Which marketing messages drive waitlist signups, which content pieces generate most engagement, and which positioning angles resonate reveals competitive messaging opportunities. This response data identifies which competitive advantages matter most to customers versus which advantages businesses emphasize but customers ignore.

Messaging analysis examines conversion rates across different positioning frameworks—enabling evidence-based positioning that resonates with actual customer priorities rather than assumed differentiation. Features that businesses consider competitive advantages but don't drive conversions may be less important than assumed.

Content response patterns also reveal which problems customers are actively researching and which solutions they're evaluating. High engagement with specific content topics indicates market pain points that positioning should address prominently.

The Competitive Event Correlation

Waitlist signup spikes correlated with competitor events—price increases, service outages, security breaches, feature deprecations, policy changes—reveal which competitive vulnerabilities create switching opportunities. These correlations enable strategic competitive monitoring and rapid response to capitalize on competitor missteps.

Event correlation analysis identifies early warning systems for competitive opportunities. Monitoring competitor changes and tracking waitlist signup responses reveals which competitor actions create switching consideration. This intelligence enables proactive competitive strategy rather than reactive responses to market changes.

The event patterns also forecast future opportunities. If specific types of competitor actions consistently drive signup spikes, monitoring for those actions across all competitors enables predicting and preparing for switching windows before they occur.

The Competitor Customer Satisfaction Inference

Waitlist behavior patterns from customers of specific competitors reveal satisfaction levels that competitors may not publicly acknowledge. High waitlist signup rates from a competitor's customers suggest widespread dissatisfaction that creates vulnerability. Low signup rates despite market presence suggest strong competitive positions that require different strategic approaches.

Satisfaction inference works because customers rarely switch from products they're satisfied with unless dramatically better alternatives appear. High switching consideration indicates problems with current solutions—either feature gaps, service quality issues, pricing dissatisfaction, or strategic concerns about vendor viability.

The inference becomes particularly valuable when correlated with customer tenure. If a competitor's customers join your waitlist shortly after adopting that competitor's product, it suggests poor onboarding or immediate feature gaps. If they join after years of usage, it suggests gradual satisfaction erosion or changing needs that competitors haven't adapted to address.

Basecamp discovered critical satisfaction intelligence when analyzing switching patterns from project management competitors. They found that customers switched from complex enterprise tools after extended usage periods, typically when team growth made those tools' complexity untenable. This pattern revealed that enterprise tools satisfied small teams initially but failed to maintain satisfaction as organizations scaled—creating a specific competitive vulnerability Basecamp could exploit through simpler tools that scaled better for growing teams.

The Product-Market Fit Validation

Waitlist demographic and firmographic patterns reveal whether your positioning resonates with intended target markets or attracts unexpected segments. Significant divergence between intended customers and actual waitlist composition suggests positioning adjustments or pivot opportunities toward segments showing stronger organic interest.

Product-market fit intelligence is particularly valuable early in company lifecycle when positioning assumptions haven't been validated. Discovering that small businesses join at 10x rates compared to enterprises despite enterprise-focused positioning suggests reconsidering target market assumptions before committing resources to the wrong segment.

The validation also reveals positioning message effectiveness. If specific customer segments join after specific marketing campaigns or content publication, it demonstrates message-market fit that should be amplified. Segments that don't respond to targeted positioning despite meeting ideal customer profile criteria suggest positioning weaknesses requiring adjustment.

The Competitive Feature Prioritization

Which features waitlist members request most frequently, which capabilities they describe as "must-haves" versus "nice-to-haves," and which functional gaps they articulate reveals competitive feature priorities that should drive product roadmap decisions.

Feature prioritization from competitive intelligence differs from general product feedback because it's explicitly comparative. Customers articulate which features they need that competitors don't provide—revealing specific competitive advantages to build rather than general improvements. This competitive framing creates more actionable product insights than generic feature requests.

The prioritization also reveals which competitor features aren't actually important despite being heavily marketed. When customers switching from competitors never mention specific features as gaps, it suggests those features don't drive value despite competitive emphasis—enabling simpler products that avoid feature bloat while focusing on truly differentiating capabilities.

Superhuman used waitlist feature discussions to identify that email speed was the critical competitive dimension that incumbents had neglected. While competitors added features, customers consistently described wanting "fast email" as their primary unmet need. This intelligence enabled Superhuman to focus entirely on speed as their competitive advantage rather than competing on feature breadth against entrenched incumbents.

The Market Maturity and Timing Intelligence

Waitlist growth patterns, signup momentum, and market penetration velocity reveal whether markets are ready for new entrants or still nascent. Accelerating waitlist growth suggests market maturity reaching tipping points where competitive displacement becomes viable. Slow growth despite strong product-market fit may indicate markets not yet ready for category innovation.

Timing intelligence helps avoid premature market entry where customers aren't ready to switch despite competitor inadequacies. Some markets require incumbent failures or ecosystem maturity before alternatives gain traction. Waitlist patterns reveal whether timing is optimal or whether patience is strategically appropriate.

Market maturity signals also indicate competitive response likelihood. Mature markets with large incumbents and high switching costs require different competitive strategies than nascent markets without entrenched alternatives. Waitlist patterns reveal which scenario applies—informing competitive strategy development.

The Channel and Distribution Insight

How waitlist members discover your product, which channels drive signups, and which discovery paths they describe reveals distribution opportunities and competitive channel advantages. This intelligence identifies where competitors have weak distribution presence—creating opportunities for channel-based competitive advantages.

Channel analysis examines whether organic search, social media, word-of-mouth, paid advertising, or content marketing drives waitlist growth. Channel effectiveness differences indicate competitive vulnerabilities where incumbents have poor presence—enabling focused channel investment for efficient customer acquisition.

Distribution intelligence also reveals platform opportunities. If waitlist members predominantly discover your product through specific platforms or communities, deep platform integration or community engagement creates distribution advantages competitors without similar platform relationships can't easily replicate.

The Competitive Messaging Gap Analysis

Comparing how customers describe their problems versus how competitors message their solutions reveals positioning gaps. When customer language differs substantially from competitor marketing language, it indicates messaging misalignment that creates positioning opportunities.

Messaging gap analysis identifies whether to position as better (solving known problems better) or different (solving different problems). If customer problems align with competitor messaging, better positioning works. If customer problems differ from what competitors address, different positioning creates category separation.

The gap analysis also reveals educational opportunities. When customers struggle to articulate problems that your product solves, it suggests market education requirements. When they articulate problems clearly but competitors don't address them in messaging, it suggests awareness exists but solutions don't—enabling capture of existing demand rather than creating new demand.

The Ecosystem Partner Identification

Which companies waitlist members work for, which vendors they mention, and which technology partners they reference reveals strategic partnership opportunities. These ecosystem insights identify companies whose customer bases would benefit from your product—creating channel partnership opportunities.

Partner identification also reveals integration priorities. Technologies that waitlist members use frequently become integration targets that enable product adoption within existing workflows. Building these integrations early creates switching advantages that reduce adoption friction.

Ecosystem intelligence can identify acquisition targets or merger opportunities. Companies whose customers show strong interest in your waitlist but whose products serve adjacent needs may represent strategic combination opportunities that create more complete solutions.

The Competitive Blind Spot Discovery

Patterns in what customers need that no competitor addresses reveal competitive blind spots—market needs that all incumbents have missed or deprioritized. These blind spots represent blue ocean opportunities for category creation rather than direct competition.

Blind spot discovery requires analyzing not just what customers want that your product provides, but what they want that neither your product nor competitors currently address. These unserved needs indicate innovation opportunities that could redefine markets rather than capturing share in existing markets.

Discovering blind spots is particularly valuable because building solutions for unserved needs avoids direct competition while potentially creating winner-take-all category leadership. The first company to address systematic blind spots often becomes category definition leader.

Stripe discovered a critical competitive blind spot when analyzing waitlist conversations revealing that developers hated payment integration complexity but no payment processor had prioritized developer experience. All incumbents competed on payment processing reliability and pricing while ignoring the integration experience that developers considered most painful. Stripe built their entire competitive strategy around developer experience excellence, creating new category expectations that incumbents struggled to match because their organizations weren't structured around developer needs.

The Competitive Response Prediction

Waitlist intelligence about competitor customer switching patterns, satisfaction levels, and vulnerability points enables predicting how competitors will respond to your market entry. This predictive intelligence informs defensive strategies that mitigate competitive responses before they impact growth.

Response prediction examines which competitive advantages are easily replicated versus defensible. Features that competitors can quickly copy require different strategies than advantages based on network effects, brand positioning, or ecosystem lock-in that competitors can't easily overcome.

Predicting responses also identifies pre-emptive defensive strategies. If analysis suggests competitors will respond with price cuts, building superior economics enables surviving price wars. If responses will emphasize feature breadth, focusing on specific use case excellence creates defensible positions. Understanding likely competitive responses before they occur enables strategic preparation rather than reactive scrambling.

The Market Segmentation Refinement

Waitlist patterns often reveal that assumed market segments should be refined or redefined. Customers you expected to attract don't join while unexpected segments show strong interest—suggesting segmentation assumptions require updating based on empirical market response.

Segmentation refinement is particularly valuable for go-to-market strategy. Resources should flow toward segments showing organic interest rather than toward assumed target markets that don't respond to positioning. This empirical approach avoids wasting resources on low-probability segments while capitalizing on high-probability opportunities.

The refinement also reveals subsegmentation opportunities. Broad segments like "small businesses" or "enterprises" often contain very different subsegments with distinct needs, buying behaviors, and competitive alternatives. Waitlist patterns reveal these subsegments more accurately than assumed segmentation frameworks.

The Acquisition and Retention Correlation

Correlating waitlist characteristics with post-conversion retention and expansion reveals which early signals predict customer success. This intelligence enables focusing acquisition on customer types most likely to succeed—improving efficiency by avoiding customers with high churn probability.

Retention correlation identifies ideal customer profiles based on observed outcomes rather than assumptions. Segments that join waitlists with certain characteristics and then show high retention become priority acquisition targets. Segments that join but churn quickly become deprioritized or avoided entirely.

The correlation also informs product development priorities. If customers from specific competitors show low retention, it suggests product gaps that prevent successful migration from those specific competitive alternatives. Addressing these gaps improves retention while making competitive displacement more effective.

The Strategic Positioning Framework

Competitive intelligence from waitlists should inform comprehensive positioning frameworks that exploit competitor weaknesses while avoiding competitive strengths. This strategic positioning creates sustainable advantages rather than head-to-head battles in areas where competitors have advantages.

Framework development examines all intelligence dimensions—geographic vulnerabilities, segment gaps, feature inadequacies, pricing weaknesses, messaging disconnects, and blind spots—to identify positioning that maximizes competitive advantages while minimizing competitive disadvantages.

The framework should be dynamic, updating as competitive landscape evolves and as new intelligence emerges from ongoing waitlist analysis. Static positioning based on initial intelligence becomes obsolete as markets mature and competitors respond—requiring continuous intelligence integration and positioning evolution.

The Competitive Intelligence Infrastructure

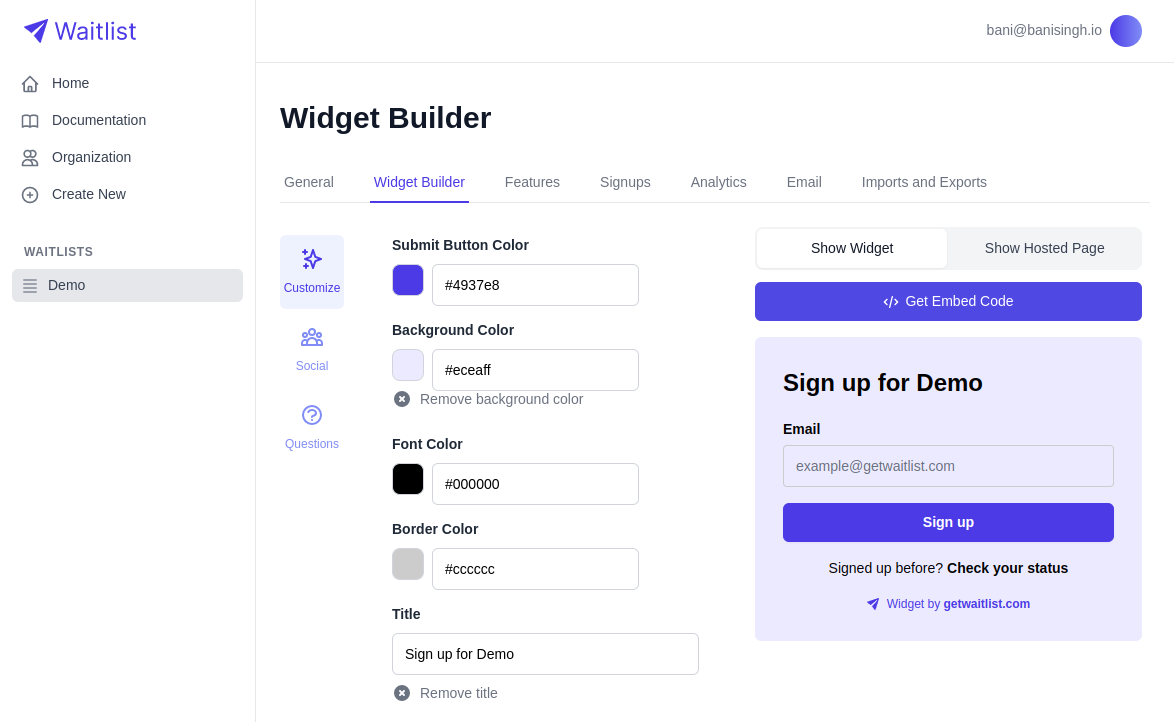

Extracting full value from waitlist competitive intelligence requires systematic infrastructure for capturing, analyzing, and acting on insights. This includes survey design that captures competitor information, analytics systems that identify patterns, and organizational processes that translate intelligence into strategic decisions.

Infrastructure should capture both quantitative data (which competitors people use, demographic patterns, conversion correlations) and qualitative insights (why people switch, what they like about competitors, what frustrates them). The combination provides statistical significance with strategic context.

Most importantly, infrastructure should enable rapid translation of intelligence into action. Discovering competitive vulnerabilities provides value only when product, marketing, and sales teams can respond quickly with targeted strategies that exploit those vulnerabilities before competitors adapt.

The Continuous Intelligence Evolution

Competitive intelligence from waitlists compounds over time as data accumulates and pattern recognition improves. Early waitlist analysis provides initial insights that inform strategy. Ongoing analysis reveals how competitive dynamics evolve, how competitor responses affect market positioning, and how customer needs shift over time.

Evolution enables predicting competitive trends before they become obvious. Early pattern recognition identifies emerging competitor weaknesses, growing market segments, and shifting customer priorities that create strategic opportunities for businesses with sophisticated intelligence capabilities.

The continuous evolution also builds institutional knowledge about competitive dynamics that becomes organizational competitive advantage. Companies that develop sophisticated intelligence capabilities can make better strategic decisions faster than competitors without similar intelligence infrastructure.

The Intelligence-Driven Strategy

The most successful businesses integrate competitive intelligence from waitlists into all strategic decisions—product roadmaps, positioning strategy, geographic expansion, pricing, partnership development, and competitive response. This intelligence-driven approach replaces assumption-based strategy with empirical decision-making based on actual market behavior.

Intelligence-driven strategy is particularly powerful because it identifies opportunities competitors can't see and validates assumptions competitors make incorrectly. This information asymmetry creates strategic advantages that compound over time as better decisions compound into better outcomes.

Your waitlist isn't just collecting potential customers—it's accumulating competitive intelligence that reveals market positioning opportunities, competitor vulnerabilities, and strategic advantages that traditional market research would cost millions to discover. The question isn't whether competitive intelligence exists in your waitlist data. It's whether you'll build the analytical capabilities to extract and act on intelligence that's already there, waiting to transform your competitive strategy from assumptions to empirical insights.